Bitcoin at 90 thousand dollars by the end of 2024? How can this prediction come true?

- Bernstein predicted a potential market expansion for Bitcoin and Ethereum ETFs.

- Technical analysis supports Bitcoin’s bullish trends, despite recent consolidation phases.

Despite recent fluctuations, Bitcoin is [BTC] market trajectory remains a focal point for investors and analysts.

Over the past week, Bitcoin has struggled to maintain its momentum above the $70,000 mark, although it touched $71,000 earlier last week.

However, that price was short-lived as it subsequently retreated, trading at $68,122 at press time. That was down 2.4% over the past seven days, although there was a modest recovery of 0.6% over the past 24 hours.

Bitcoin: Market Sentiments

Amid these price swings, Bernstein, a prominent asset management firm, has issued a bullish view on the potential growth of Bitcoin and Ethereum [ETH] exchange traded funds (ETFs).

According to a recent research report by Bernstein analysts Gautam Chhugani and Mahika Sapra, the crypto ETF market could expand to a sizeable $450 billion based on projected cryptocurrency prices.

They predicted an inflow of over $100 billion into crypto ETFs over the next 18 to 24 months, with a significant year-end price target of $90,000 for Bitcoin and an ambitious $150,000 cycle by 2025.

Further analysis of the trading company The Birb Nest under condition technical perspective, highlighting bullish indicators in the Bitcoin market.

Their study noted that the 50-week and 200-week simple moving averages (SMA) are at $43,950 and $35,358, respectively, providing strong market support fueling investor optimism.

In addition, the correlation coefficient with the S&P 500 index is moderately positive at 0.36, indicating a favorable outlook for Bitcoin in correlation with the broader financial markets.

Moreover, Bitcoin Production Cost (BPRO) and 200-day SMA are providing significant trend support at $62,580 and $53,516 respectively.

The Relative Strength Index (RSI), at 59 at press time, indicated growing buying interest, although the Momentum Index was relatively stagnant at 49.

While the market’s Fear and Greed Index indicates a “greed” sentiment at 74, The Birb Nest advises caution to mitigate risks associated with potential market overextension.

Strategic insights and future prospects

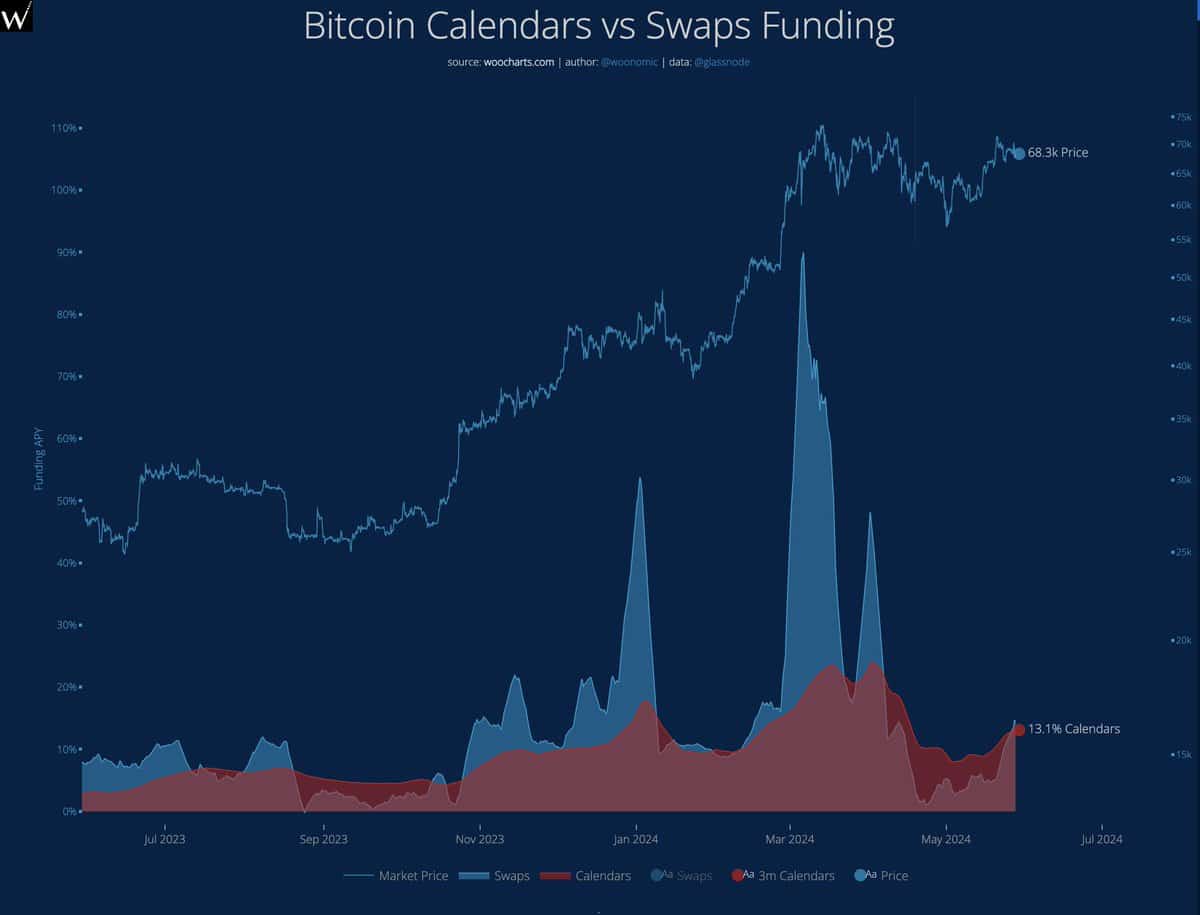

Famous crypto analyst Willy Woo contributed additional insights into Bitcoin’s recent market behavior.

He highlighted the demand for spot Bitcoin ETFs, particularly with the recent shift in market dominance from Grayscale to BlackRock, which has greatly outstripped the supply of newly mined Bitcoin.

Source: Willy Woo

Woo also noted increased demand in the futures market, particularly from retail traders, which has not yet reached levels that could indicate excessive speculative interest or fear of missing out (FOMO).

At the same time, whales have significantly accumulated Bitcoin, indicating a potential supply shock that could put pressure on prices in the near term.

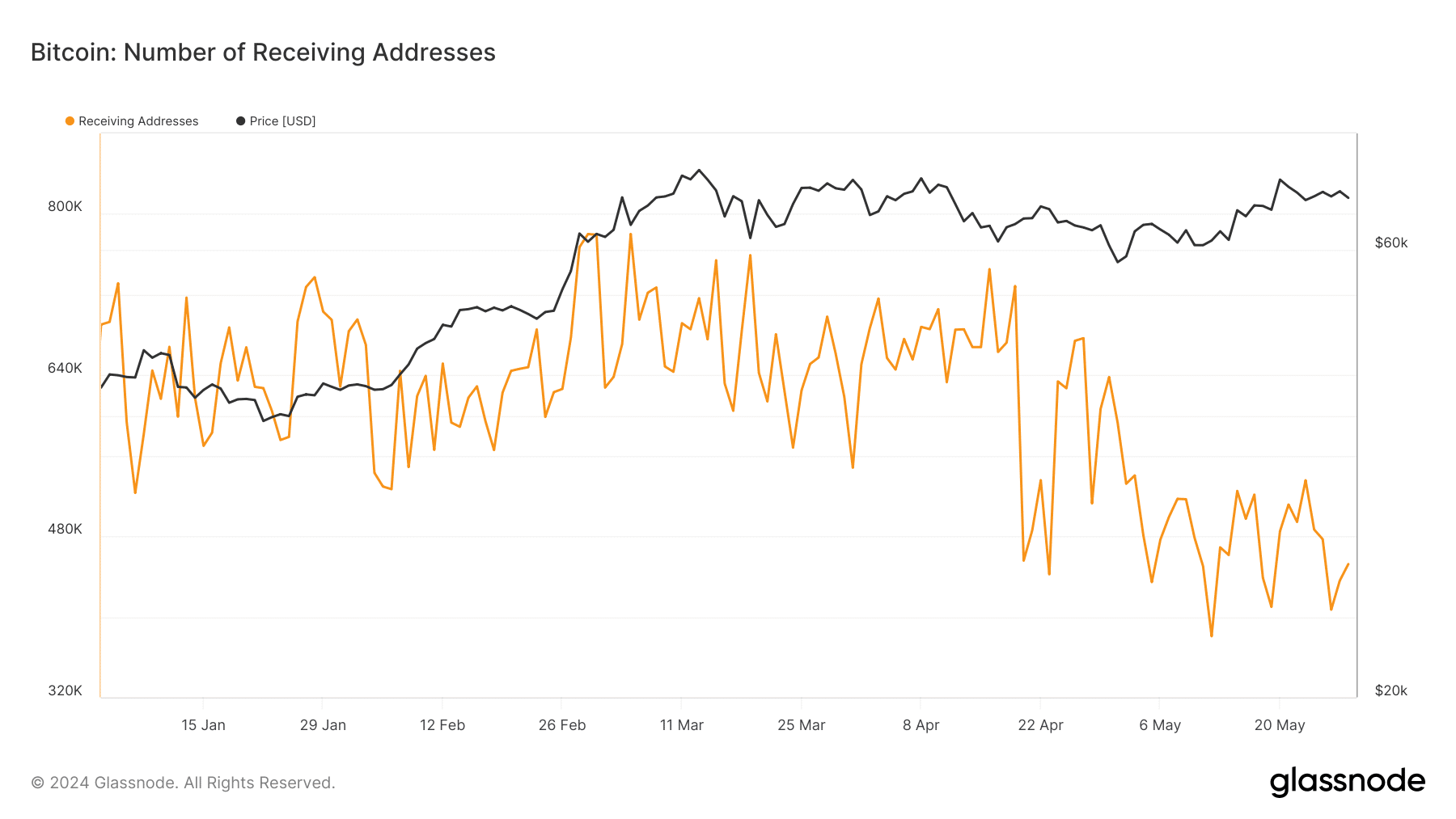

However, not all Bitcoin metrics paint an optimistic picture.

Data from Glassnode revealed a significant drop in the number of receiving addresses, indicating either a decrease in transaction activity or a consolidation of funds to fewer addresses.

Source: Glassnode

Is your portfolio green? Check BTC profit calculator

Despite these concerns, AMBCrypto recently published that the range from $66,200 to $66,700 contains a cluster of liquidation levels, suggesting that Bitcoin may temporarily fall into this region.

Conversely, liquidity at $67,800—which has already been tested—could provide the necessary momentum to push Bitcoin price back toward the $71,200 resistance level.